What Causes Long term Loss of Capital – High Valuations or Lack of Sustainable Profits

Note: This is slightly edited version of my talk delivered at Flame Alumni meet which I have reproduced based on my memory. You can download the copy of presentation from here …..Some time back I did a similar post. This time I have tried to follow different approach

Dear Friends,

First of all I would like to thanks Flame for giving me an opportunity to present my thoughts. Entire presentation is inspired from reading interviews/articles of Mr. Bharat Shah and Prof Sanjay Bakshi. Needless to mention that any error in this presentation is due to my misunderstanding.

I have a very limited value investing experience of little more than 4 years. In these 4 years my biggest learning is that it’s very important to know your investment personality and stick to it. After experimenting with deep value, turnaround situations and special situations, I realized that my personality is best suited for buy and hold kind of investment, where one buys and hold the stocks for five years or more.

During the initial years I struggled a lot on valuations and kept asking everyone how they arrive at intrinsic value of a stock. I was of the belief that to avoid permanent loss of capital, valuations are of outmost importance. And then I came across few interviews of Mr. Bharat Shah and that made me to reconsider my views. He says

“Quality growth sustained over time will enhance value. Therefore, even if one has misjudged the value and overpaid, rise in value over time will give a chance to catch up and will let avoidance of permanent loss of capital. A pure cigar butt may not enjoy such luxury.”

Above quote is very important. Take your time to go through it again before we proceed further.

The first question which came to my mind after reading above quote was to check how many companies have destroyed wealth over period of time even after delivering quality growth.

[Note: In Indian context I am interpreting quality growth as situations where PAT CAGR is more than 15% and average ROE is more than 15%, so that it’s a self-funded growth. The number 15% is not that important. What’s important is that this number should be equal to or more than nominal GDP growth of the country over long term….then only I think it’s possible to beat inflation and earn some real rate of return.]

Mathematically the above quote can be represented thus

Now in the first case where intrinsic value is growing at 15% and intrinsic value is INR 50crs, suppose one misjudges value and by mistake buys this stock at INR 100crs. It will take five years for intrinsic value to catch up with the excess price paid. But if one continue to hold it for longer term and profits remain sustainable then growth will bail you out. If one holds this stock for 10 years, one suffers in terms of returns and not nominal capital.

Now let’s take the third case where intrinsic value is either flat or declining. If by mistake one overpays here, it will result in permanent loss of capital.

Approach followed

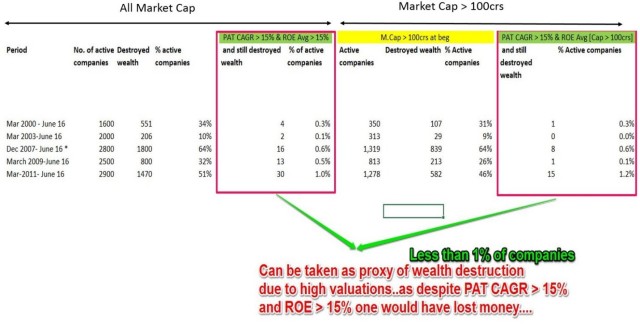

To verify the previous statement by Mr. Bharat Shah, I have tried to find cases where wealth destruction has happened despite PAT growing at 15% CAGR and average ROE more than 15% for various periods like 2000-16, 2003-16, 2007-16, 2009-16 and 2011-16. Valuation is always subject to the earnings growth. So, if one has incurred loss even after PAT grew at more than 15% CAGR while maintaining ROE above 15% and still have incurred losses, we can say that most probably one has overpaid at the time of buying. [Only exception is if at the time of selling markets are extremely depressed]. I have assumed that one will buy at the beginning of the period and will continue to hold the stock till the end of this period.

The entire study is based on historical numbers whereas in investment one need to assess future. One can reject this study as HINDSIGHT and SURVIVALSHIP BIAS. But I think one can learn from history on what has worked and what has not worked in the past.

Finding of study

Except for 2003-16 period, in all other periods 30-50% of the active companies have destroyed wealth.

But when we consider the companies which were able to grow their PAT at more than 15% CAGR and at the same time maintain their average ROE at more than 15%, only less than 1% of the companies have destroyed wealth.

Results are similar even if we exclude companies with market cap of less than 100crs in all periods. In the above study I have ignored valuation, not because I think valuation are not important. But I want to find out what happens even if one ignore the valuations and focus exclusively on sustainable profits.

Source: Motilal Oswal Wealth Creation Study 1993-98

Even for 1993-98 period results are same. Most of the companies which destroyed wealth had low ROE.

Nifty-Fifty

As per one study, even if one had bought the infamous Nifty-Fifty at the peak of Dec 1972 and held it for the next 25 years, results would have closely matched S&P 500. Now S&P 500 is rebalanced often and underperformers keep getting eliminated whereas Nifty-Fifty remained same throughout the 25 years. Even then the results of Nifty-Fifty closely matched S&P 500

Bad News!!!

Is it easy to find companies which can sustain their ROE at more than 15% for next 10 years or more? Not at all. As per study conducted by Motilal Oswal out of 2,400 active companies in 2004, ROE was more than 15% for only 26% of them. By 2014 this ratio declined to 4%.

In other words with perfect hindsight, in 2004 there were only 4% of the active companies with sustainable ROE of more than 15% for next 10 years.

So now the obvious question is how to find such companies?

Before we reject the entire study saying that its only SURVIVORSHIP AND HINDSIGHT BIAS, let’s see what Prof. Sanjay Bakshi has to say. He says

“Take any idea in value investing and you’ll find the same survivorship bias. But extreme success in investing has come to those who have found patterns that have worked really well. ……..

…….Mr. Taleb has roughly said that there won’t be enough data in Mr. Buffett’s lifetime to know if he had any skill or whether he was just lucky.

Mr. Bakshi further adds that

“Take Charlie Munger. He talks about learning by studying great failures and great successes and identifying common elements. He wants you to recognize patterns. If there’s a pattern associated with success, he implicitly assumes causality. If there’s a pattern that’s associated with failure, he does that again. He said avoid the patterns that cause failure (all I want to know is where I am going to die, so I never go there). He says look for patterns which “produced” extreme successes and if you find them, back up the truck on them….. “

He further adds that

“Maybe, just maybe there’s a pattern which helps us understand what’s a good business and what’s a bad business ex ante and not ex post…..”

Seek Answers in Past Success and Failure Patterns.

All the sources of permanent loss of capital can be broadly classified into four

- Management risk

- Business Risk

- Balance Sheet Risk

- Valuation risk

Out of the above valuation risk can be managed by having some thumb rules. It’s the management, Business and Balance Sheet risk which is most complex to understand and evaluate. I have no easy answers on how to analyze this risk. Following Mr. Bakshi advice I am trying to study past success and failure patterns. This is still a work in progress. Here I would need help of all of you.

I request you to please share the patterns which you have observed in your failed ideas or companies which have not done well. Also the patterns which you have observed in the companies which have done extremely well. My email id is anilt@contrarianvalueedge.co.in or anil1820@gmail.com

Good Business vs Bad Business

Based on the finding of this study I have tried to classify the entire business universe into two:

1) Good Business

2) Bad Business.

A Good business [Non-financial] is one which over long term can sustain Sales, PAT and EPS CAGR > 15% while maintaining ROCE and ROE > 15%

All the five items [Sales, PAT, EPS, ROCE and ROE] need to be above 15% [or equal to or above nominal GDP growth rate] for it to be sustainable growth.

Mere high ROE does not make any business Good Business [Even if ROE > 50%] e.g.. HLL, Castrol etc. At minimum, Sales and PAT CAGR should be equal to or higher than nominal GDP growth rate.

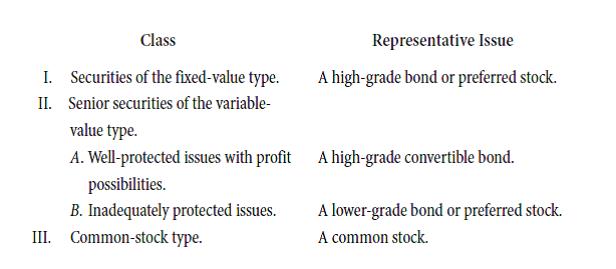

Source: Security Analysis, Benjamin Graham

If a company provides only assurance of long term durability without any assurance on minimum growth in intrinsic value over long term [> 5-8 yrs.], then I would classify such companies under Class II rather than under Class III.

In the words of Mr. Bharat Shah

“When growth goes away, Equities reduced to a Bond. It will be treated like a bond for a while. If the picture deteriorates further, then it will be treated worse than a bond”

None other than Seth Klarman has said

“Price is perhaps the single most important criterion in sound investment decision making. Every security or asset is a “buy” at one price, a “hold” at a higher price, and a “sell” at some still higher price. “

How do we reconcile this entire presentation with the above quote?

I am not suggesting it’s impossible to make money in bad businesses. What I am saying is that almost all cases of permanent loss of capital has happened in bad businesses. If one is buying bad businesses one should be careful of entry and exit timing. In such businesses your losers will control your return.

Notes on data:

1) Source of data: Ace Equity

2) No adjustment made for spin-offs and mergers

3) Dividends are ignored in the calculation of return

please substantiate how “PAT CAGR is more than 15% and average ROE is more than 15%, so that it’s a self-funded growth” the same would be helpful in understanding it better, thanks a lot.

LikeLike

Apologies.. Can you elaborate more on your question..

Any way what I mean is that is any growth is driven by reinvestment in business – either in working capital or capex. Its rare for a business to be able to grow without reinvestment.. So if ROE > 15% company can reinvest from internally generated resources so as to be able to grow 15% in future [assuming zero dividend payout]

LikeLike

Good one. Thanks for sharing your thoughts.

LikeLike

Pingback: Failure Patterns of Companies | ContrarianValue Edge

Hi.

Thanks for a very good article. But how do u predict growth. By seeing the past number? Then titan would be a very home candidate. But we know it’s under performing . How do you see this problem?

Thanks in advance

LikeLike