Note: Unless otherwise stated, entire text in this blog post is from two books 1) Art of Value Investing 2) Art of Short Selling . David Einhorn quotes are from his book Fooling Some of The People All the Time. My comments are in italics.

Let me make it clear at the outset that I had never done short selling nor do I plan to do in future. But I found principles of short selling technique to be equally helpful to long-term investors. For short sellers the maximum upside is 100% whereas downside is UNLIMITED. These asymmetrical returns force short sellers to be much more diligent and conservative compared to long only investors. I was surprised to note that most successful short sellers NEVER SHORT ANY STOCK MERELY ON OVER-VALUATION. I am not talking here about short sellers who short a stock in the morning and cover their position by the end of the day. I am talking about short sellers, who after deep analysis create a position and hold on to it until their conviction pays off.

Charlie Munger once said, ‘All I ever want to know is where I’m going to die, so I never go there’. My sole attempt at studying short selling technique is to find what successful short sellers look for in a good short and to avoid such stocks.

Study of short selling technique helps in solving the puzzle “When to sell” & What to avoid

The point is that the toughest call for investors-even in a bull market-is when to sell. The best managers either sell stocks soon with a small loss, realizing a mistake, or sell stocks later, noting a change in prospect after gains, when prices begin to drop. Short-selling skills teach us the discipline of anxiety, of when to be scared. The analytical wisdom shows us when the numbers start to turn bad in a sacred-cow holding or which stocks not to buy at all. Individuals can employ the analytical techniques of short selling to avoid owning stocks that will explode otherwise well-conceived portfolios and to escape the new-issue frenzy of rabid retail brokers. Knowledge of professional methods of short selling saves money in the long run.

When to sell

Focus on deteriorating fundamentals rather than on VALUATIONS ALONE

Jim Chanos discussed about his firm stock selection methodology for shorting stocks during his testimony to US SEC in 2003.

Kynikos Associates selects portfolio securities by conducting a rigorous financial analysis and focusing on securities issued by companies that appear to have (1) materially overstated earnings; (2) an unsustainable or operationally flawed business plan; and/or (3) engaged in outright fraud.

One can notice absence of any reference to valuation in the above statement. In my view, its intentional. Business fundamentals, quality of earnings and management honesty is given more importance over valuation.

We’re not playing for a multiple reduction, or a reversion to the mean for the industry. My biggest mistakes have generally been because I stayed with shorts just because they were expensive. The multiple game is a dangerous one— valuations can be crazy and stay crazy. We typically want to see something already or soon to be going very wrong. Our best shorts in the past 10 years, in fact, have been more in low-multiple companies, where we believed the earnings were illusionary.A lot of our best shorts have looked cheap all the way down. Just because something is cheap doesn’t make it a good value. A lot of times the company can get into distress due to a declining business. That defines a value trap —Jim Chanos, Kynikos Associates [See Jim Chanos presentation on value trap for more examples]

We look at the same things everyone else does but with the idea that these are moving targets. Balance sheets should give you some sense of intrinsic value on the downside. On the upside, we have to worry about the unlimited potential. We look at things like market sizes and the law of large numbers, as to whether companies can grow their way out of a bad accounting situation or a leveraged situation. On the short side, the financials are often misleading. What might appear to be value sometimes is not. A book value that is comprised of goodwill and soft assets sometimes might not provide downside support if a company is troubled. Valuation itself is probably the last thing we factor into our decision. Some of our very best shorts have been cheap or value stocks. We look more at the business to see if there is something structurally wrong or about to go wrong, and enter the valuation last – Jim Chanos interview with Columbia Business School

For the most part, we avoided the damage in the short portfolio by refusing to sell short anything just because its valuation appeared silly. We reasoned that twice a silly valuation is not twice as silly. It is still just silly. Kind of like twice infinity is still infinity. Instead, we concentrated on selling short companies with high valuations combined with misunderstood fundamentals and deteriorating prospects. As always, frauds were preferred. – David Einhorn

A good company is a company with smart management who pay attention to business trends and customers and who have financial statements reflecting that unlikely blend. If the stock is sold short simply because of valuation, the market immediately shows how high the earnings multiple can go. Buy index puts, instead; a valuation short is no different than a market bet. If the stock is shorted because of perceived temporary problems and because of excessive valuation, good management can fix the problems fast.

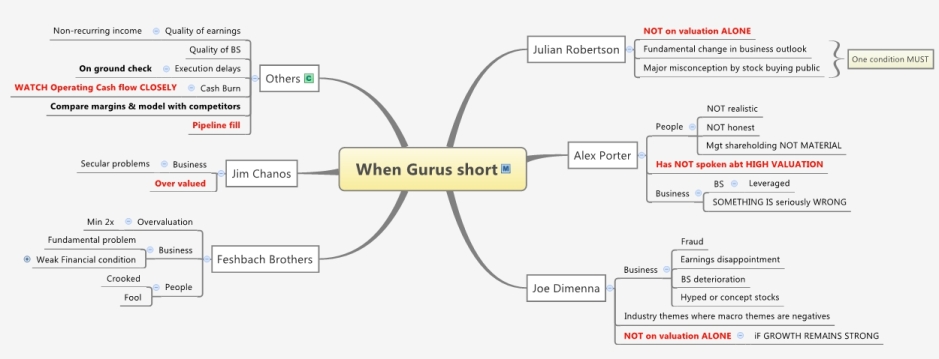

(click on the image to enlarge)

Which companies or sector or situations to avoid

Debt-financed asset bubbles

The first and most lucrative category of short ideas are the booms that go bust. Booms are defined as anything fueled by debt/credit in which the asset’s cash flows do not cover the cost of the debt. We’ve had our most success with debt-financed asset bubbles—as opposed to just plain asset bubbles— where there are ticking time bombs in terms of debt needing to be repaid, and where there are people ahead of the shareholders in the bankruptcy or workout process. The debt-financed distinction is important. It kept us from shorting the Internet in the 1990s— that was a valuation bubble more than anything else. —James Chanos, Kynikos Associates

Technological obsolescence – the old/incumbent product is usually replaced faster than the consensus believes it will be

The next category involves technological obsolescence. Economists talk quite rightly about the benefits of “creative destruction,” where new technologies and innovations advance mankind and grow GDPs. But such changes also render whole industries obsolete. Disruptive technologies have two sides and always have. You saw it in the 1980s as personal computers wiped out the word-processor and minicomputer markets. What’s playing out now is the transformation from an analog to a digital world. While that’s created great fortunes like Google’s , it’s also wiping out whole businesses. Traditional music retailing was one of the first to start going. Then came video rental. Value investors will invest into these types of markets at their peril. Cash flows evaporate faster than you ever dreamed. —James Chanos, Kynikos Associates

In fact, I’ve given some lectures on the concept of value traps. Probably our best ideas over the past ten or 12 years have been ideas that looked cheap and which actually ensnared a lot of value investors. The investors didn’t realize that these businesses were deteriorating faster than their ability to generate cash. Eastman Kodak was a great example of that. A few famous value investors were buying it all the way down because they assumed that the decline in the business would be a slow glide that would allow the company to harvest cash flows for the benefit of shareholders. The fact of the matter is that, for most declining businesses, management tends to redeploy cash flow into things outside of their core competencies in a desperate attempt to save their jobs. In the case of Kodak, they took some of their patent proceeds and cash flow and invested in a printer business, which is another declining business model. They ended up being decimated by their own invention of digital photography. When analyzing Kodak as a short candidate, valuation was almost the last aspect that we considered because, as I said, some of the best short ideas can look cheap from a valuation standpoint – Jim Chanos interview with Columbia Business School

Companies with weak moats and excessive leverage

We’re looking for companies with weakening moats, often coupled with a resulting deployment of capital into areas in which they have no competitive advantage. Even better is when they’re deploying not just excess capital, but leveraging the balance sheet to do so. —James Crichton, Scout Capital

We also look for long-term structural declines— kind of the opposite of what we look for on the long side. Wall Street tends not to fundamentally mark stocks down until bad news actually shows up in the numbers. We’ll ignore the supposed value today and focus on whether we think the “E” in a P/ E is going to be materially less in three to five years. —Ricky Sandler, Eminence Capital

Avoid blind cloning

I guarantee that in every great blow-up there has been at least one big-name investor involved all the way down. Don’t stop your work on the downside because you can’t imagine so-and-so owner making a mistake. It happens all the time. —James Chanos, Kynikos Associates.

Emerging moats or traps

The next level of financial complexity is a concept or theme stock from companies that sell a product or service to fill a newly perceived need. By taking a cynical look at business plans, the investor can determine which of the numerous innovators might succeed and can then take advantage of brokerage hysteria and enthusiastic price inflation to sell the stock. The odds are with the short sellers: New-business statistics show failure rates far in excess of success. From the short point of view, the most important decision on a concept stock is: Does this work-is the prospective return worth the risk for the stockholder? The second question is: How soon will the new company run out of money? – Art of Short Selling.

Dead Companies Walking have few interesting examples of companies which might appear to be emerging moat at the time of investment but whose business plan itself was fundamentally flawed.

Chemtrak [Stock symbol: CMTR] only product was an over -the-counter blood test for cholesterol levels. Chemtrak’s management was much more cerebral in their approach. They had scientifically analyzed the health-care market and come up with a product they were convinced would fill an important need. The problem was, their analysis was just plain wrong. Even though heart disease is a major problem in this country, American consumers were simply not going to buy what Chemtrak was selling. Lots and lots of very smart people make this mistake. They fixate on some given set of data or analysis instead of the most important data set of all: how people in the real world behave. You can know everything there is to know about your industry— market trends, leading indicators, the latest technology—but if you don’t know your own customers, you might as well be trying to sell gumbo to gray-haired flower children.

PlanetRx (stock symbol: PLRX) launched a website which allows customers to order prescription drug online. The biggest flaw in the business model was customers had to wait 2-3 days before they receive their medicine. The majority of people who used prescription medications were senior citizens. Company failed to appreciate that customers can simply drive down to the local drugstore and get their pills in fifteen minutes.

Consumer fads

Investors—typically retail investors— use recent experience to extrapolate ad infinitum into the future what is clearly a one-time growth ramp of a product. People are consistently way too optimistic and underestimate just how competitive the U.S. economy is in these types of things : Cabbage Patch Kids in the 1980s, NordicTrack in the early 1990s, George Foreman grills in the early 2000s. —James Chanos, Kynikos Associates

Accounting irregularities where the economic reality is significantly divorced from the accounting presentation of the business

We also look for accounting irregularities, which can run the gamut from simple overstatement of earnings , often a gray area, to outright fraud. We’re trying to find cases where the economic reality is significantly divorced from the accounting presentation of the business. It’s not GE managing earnings— everybody does that. We want to see something way beyond that, where management is going out of its way to mislead. It could be the hiding losses in offshore subsidiaries like Enron. It could be abusing mark-to-market accounting as Baldwin-United and many others did. It could be Boston Chicken, a big winner for us in the 1990s, lending money to franchisees to cover losses and not reserving for the receivables. The biggest abuse in accounting today, often legally, is in acquisition accounting. —James Chanos, Kynikos Associates

We primarily look for material disconnects between our view of economic earnings and the earnings that are reported and people are using to value the stock. It could be accounting related, so we pay careful attention to things like rising accounts receivable relative to total sales, cash from operations that is not keeping pace with net income, and decreasing returns on capital —James Crichton, Scout Capital

I have developed something called the C score, which is basically a six-variable method for searching out ideal short candidates that are potentially manipulating earnings. The variables are a growing difference between net income and cash flow from operations, increasing days sales outstanding, growing days sales inventory , growing other current assets to revenues, declining depreciation relative to gross property, plant and equipment and, finally, total asset growth greater than 10 percent. There’s a high probability that companies that score high on those six measures are actually manipulating earnings. By also requiring some measure of high valuation, say a price/ sales ratio greater than 2 ×, we can imagine stock prices for the remaining companies going south quite fast. —James Montier, Société Générale

The accounting-based analysis is not difficult to do, but it takes time, patience, and a suspension of belief. A Wall Street pundit recently commented that this level of fine-toothed work is too costly for brokerage analysts or institutional managers to perform because of the time and skill required. The lack of attention by other professional investors to these financial details provides the inefficiency in information dissemination that is so central to the short seller’s art.

Reading notes to account much more important now

Managements have gotten so good at playing Wall Street that I’ve actually become more skeptical of the metrics they want you to focus on. For example, when people would question the earnings at Tyco, former management would say “There can’t be anything wrong with earnings, just look at our cash flow.” It turns out that just about every cash-flow lever possible was being gamed at Tyco. Capital spending never seemed to grow, until you looked at the footnotes on future contingencies and saw they were calling everything operating leases that never showed up in the capital spending Always read all of the documents. “Footnotes and disclosures buried deep in corporate 10-Q and 1-K reports.”

Focus on Quality of earnings

The quality of earnings is a major issue with short sellers. Companies repeatedly try to include nonoperating earnings in “earnings” to create the appearance of growth and financial well-being. This subterfuge requires the analyst to read the footnotes and the management discussion of earnings in the 10Q. Sometimes in extreme cases (Crazy Eddie in Chapter 10), the verbiage is dramatically different in the quarterly report and press releases than in the 10Q.7

Look for accounting gimmicks: Clues that the financial statements do not reflect the true state of corporate health.

The next level of complexity combines costs and revenues-the company manages earnings by delaying expenses and accelerating revenues. The asset side of the balance sheet rises as prepaid expenses build, and net income stays consistent, always upward by a comfortable growth rate. Companies that have perfect growth rates should always be carefully studied for gimmickry on the balance sheet-in particular, burgeoning prepaid expenses and deferred costs.

I did a guest post on “Financial Shenanigans” written by Dr. Howard Schilit here. This is an excellent and must read book to asses the quality of earnings and balance sheet.

Mere accounting irregularity is not enough, focus on the fundamentals of the business

I evaluated shorting America Online and determined that even if the accounting were wrong, it was a lousy short because the true economics of the business were incredibly compelling. The stock was inexpensive considering the company’s economic profits. I calculated the net present value of a subscriber by comparing the up-front cash customer acquisition costs to the subscription payments over the expected life of the customer relationship. America Online was adding so many new customers that it would not take long to justify its seemingly lofty stock price. Add in the possibility of new revenue streams, including advertising, and I saw it was a really bad short idea. Perhaps this is what “value investor” Bill Miller saw that convinced him to step out of the box and take a large long position. I did not have the guts to buy America Online, but contented myself by not shorting it and arguing with those who did – David Einhorn

Joe Feshbach said “The mistake is always shorting the company that’s not that bad.” “The biggest mistakes we’ve made are where we’ve seen a company that is overstating earnings but where the internal engine of the business is still strong.”

We have historically been drawn to financial services, where companies can really boost earnings by generating bad loans for a while. We’ve also been in consumer products, certain parts of the natural resource situations (which effectively become accounting plays) and generally companies that grow rapidly by acquisition. Where we see the juxtaposition of a bad business combined with bad numbers, that’s really in our wheel house – Jim Chanos interview with Columbia Business School

Be wary of companies who misread or alienate their customers or do not confuse your own taste with consumers

In 2012 , JCPenney’s (stock symbol: JCP) management team famously “fired its customers” by eliminating coupons and stocking more expensive brand-name merchandise. Essentially, Johnson wanted JC Penney and its shoppers to be something that they’re not. He wanted them to be more like the scene at Apple Stores, or even Target, when in reality, there was probably more overlap with Macy’s, or even Walmart. The overall impression is that Johnson would probably never shop in JC Penney, and that he certainly didn’t understand or have much respect for the store’s shoppers. If that’s the case, no wonder Johnson’s stint as CEO was such a disaster Read more here

Johnson’s doomed upscale strategy shows the dangers of confusing your own tastes with the tastes of your customers – Dead Companies Walking

Prof Sanajy Bakshi commented something similar in response to a question on Thomas Cook

“It important to form views based on actual data rather then perceptions formed from one’s own opinions. I haven’t used a travel agent for a holiday for more than a decade. I don’t wear Relaxo flip flops. I don’t wear Killer Jeans either. Nor do I use Bajaj almond oil or any hair oil for that matter. I don’t use products made by Page Industries either. But the business volume growth experienced by companies who manufacture these products tell a different story. We should create our opinions based on actual, verifiable facts and not personal impressions because personal impressions are very often not representative of underlying reality.”

Be wary of getting ‘Too Close’ to management

The Feshbachs do not find company visits or Wall Street analysts productive ways to gather information. Talks with management are not fruitful.

One of the biggest things I see quite often is getting too close to management. We never meet with management. For all of the bad asymmetries of being on the short side, one of the good asymmetries is that we don’t rely on the company. We can get information from the company if we want to, as we can go through the sellside. Those that are long the stock and are close to the company almost never hear the negative side in any detail. The biggest mistake people make is to be co-opted by management. The CFO will always have an answer for you as to why a certain number that looks odd really is normal, and why some development that looks negative is actually positive…Jim Chanos interview with Columbia Business School

McBear keeps a low profile relative to his peers because he gathers important information by visiting companies. He feels Wall Street analysts are a poor conduit for company insights because they screen out relevant facts. A good listener asking thoughtful questions can learn critical facts about business trends.

People in management positions, even very senior management positions, are often completely wrong about the fortunes of their own companies. More important, in making these misjudgements, they almost always err on the side of excessive optimism – Dead Companies Walking

Bernie Madoff was a respected, even revered figure in the Jewish community— and many of his victims came from that world [Jewish] because of it. This is an age-old problem in both business and investing. Call it the country club effect. Even the sharpest, most astute professionals tend to perform less due diligence when they’re dealing with someone with whom they have an affinity. Whether these ties are based on ethnic, class, or family background is immaterial. The affinity fallacy happens across all groups – Dead Companies Walking

My focus is majorly on small & mid-caps companies where disclosure standards are still very pathetic for most of the companies. I do interact with management. But I try to do more than half of my research before approaching the management.

Companies with HIGH presence of institutional shareholders will fall much more steeply when earnings disappoint or if the company is facing any problem

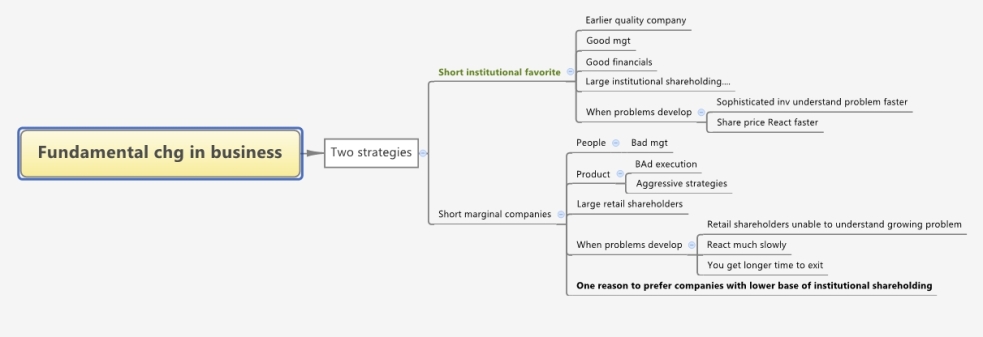

(Click on the image to enlarge)

Concluding remarks

Successful short sellers look for the following before they decide to short any stock:

- Business : Secular problems or fundamental change in the nature of business

- People: Dishonest and incompetent management.

- Balance Sheet: Higher leverage is preferred.

- Profit & Loss account: Quality & Sustainability of earnings. Simple overstatement of earnings is NOT ENOUGH. Short sellers are looking for cases where economic reality is significantly divorced from the accounting presentation of the business

- Price: Valuation is given least preference by most short sellers.

*********************************************************************************

Additional points

On Cable companies

Because they believe management when they say that gross cash flow is going way up and required capital is going way down over time. The reality is the cable executives are not blessed with any great crystal ball themselves, and we believe they always underestimate the competition. Satellite came out of the blue. Now the Bells are going to compete with them. On top of that you’ve got wireless broadband coming on. I’m convinced television programming is going to go over the Internet, an open system that’s the most efficient distribution network ever created. This I see very clearly happening – people setting programming for Internet standards. The Bells wiring fiber optics to get into the video business is going to be over an Internet standard. Everybody will be selling broadband access as a commodity. In such a world, a cable or satellite company packaging channels with some choice but not much and charging you 40% off the top is insane. At the end of the day, the cable company is the middleman. In a digital world, middlemen margins get crushed, because the marginal cost of transmitting a bit of information is zero. If you are a middleman with a closed architecture, you’re in a world of trouble. Content producers are going to find a way to reach the consumer more directly and split those 40% cable EBITDA margins with the consumer. They’ll go to Microsoft or Scientific-Atlanta and ask for an interface that’s easy to use that allows the consumer to buy programming and pay for it directly. You won’t need to pay Time Warner or Cablevision 40 cents on the dollar for that pleasure. We’ve been saying for a few years that you want to be long proprietary content and short distribution. – James Chanos, Kynikos Associates

Links to some good articles:

Lessons in short selling: Why Jim Chanos targeted Enron

Jim Chanos presentation on value traps

Excellent Article Anil ,

I believe you are most improved blogger as far as gaining knowledge is concerned in last 2-3 years . I don’t know if your portfolio gain is keeping pace with your knowledge or not 🙂 . I am sure it must.

LikeLike

The risks of being short are often overstated. In theory your losses are unlimited, but in practice that is never the case. Markets are far more volatile to the downside. Stocks are regularly halved in a day whereas they are much slower on the upside.

On longer timelines the difference becomes far more pronounced. One week can undo years of market gains.

The biggest problem with shorting are the costs, and the fact that winning positions become smaller while losers become bigger.

LikeLike

Pingback: What Long Term Investors Can and SHOULD LEARN From Short Sellers: Mere accounting irregularity is not enough, focus on the fundamentals of the business; Reading notes to account much more important now | Asian Extractor

Pingback: Bamboo Innovator Daily Insight: 31 Jan (Sat) – Winston Churchill and his ‘black dog’ of greatness | Bamboo Innovator

Pingback: 01/31/2015 - Saturday Reading - Compound Interest RocksCompound Interest Rocks

Thanks; that’s a lot of complicated fundamental stuff/work and so, more potentially error-prone.

Though I am a chronic index dip buyer/seller, in scales, because that usually works, I am always working on a shorter-term (unless and until you get lucky and jump and hang on to a run-away down move) shorting index futures strategy that attempts to find short term resistance areas that are clearly backed away from and enter short there with a fairly (but not too) tight initial stop loss.

I’m also looking at opening market strategies that seem to mostly work after the 10 minute opening bar gets emphatically violated to the downside. Trading futures index shorts only during the first hour with the occasional runner is my biggest market fantasy. 🙂

The nice thing about doing this with indexes from a short-only perspective is that you have black swan (the worst you can think of) protection and you know that your stop loss will always get filled if it’s before limit-up. But there are (though unlikely) catastrophic events that could happen while the futures markets are closed and cause the mother-of-all down gaps, with few buyers when the markets reopen or, lesser variations on that.

Not there yet with these strategies though and of course, you are fighting the tendency of the markets to go up and the motivation of the powers that be to keep them propped. 🙂

LikeLike

Reblogged this on Hartman Family Weblog.

LikeLike

Thanks for a different perspective. Valid points to consider about what does not work.

LikeLiked by 1 person

Pingback: What causes Wealth Destruction over Long term? Lack of Growth and ROE below 15% | ContrarianValue Edge

Pingback: What Can Long Term Investors Can Learn from Private Equity/Venture Capitalist | ContrarianValue Edge