Acknowledgement: In doing this part, I was immensely benefited by Prof Sanjay Bakshi presentation on Understanding the Universe of the Unknown and Unknowable. This does not mean that he will support this framework or will agree with some investment opportunities which I may identify. Needless, to mention that all errors or misinterpretation are solely mine.

You can read Part I here and Part II here

********************************

Richard Zeckhauser, in his excellent article on “Investing in the Unknown and Unknowable” has presented a matrix on uncertainty, which I think is very helpful in analyzing delisting situations.

Cases which I am discussing here, fall under BD [Hard for you to estimate and Hard for others to estimate]. This uncertainty drives away many investors. I think in such situations, one should remember three important principles, as highlighted by Prof Bakshi in his presentation.

1) Uncertainty is not risk

2) Seek uncertainty on favorable terms [Margin of Safety]

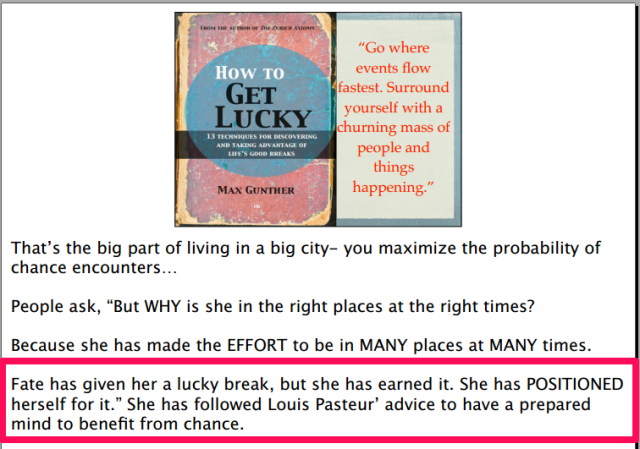

3) Have a prepared mind to benefit from luck

Lets discuss some specific cases:

Aeonian Investments

I first read about this stock on my friend Jayendra Kulkarni’s blog. When I analysed the stock it was basically a SPECULATION on delisting. But instead company announced voluntary winding up. Though it was a case of voluntary winding up it had most of the same critical factors like 1) Valuation and 2) Time risk. I concluded that it’s a case where losses are capped but upside uncertain . Within six months of voluntary winding up announcement, company distributed cash and shares worth INR 250/sh, giving a absolute return of 45-55%.

I think following factors worked in this case

- Excellent analysis by Jaynendra. After that, there was very little for me to analyse.

- Reasonable valuation [30-35% discount to my estimate of its intrinsic value]

- Reasonably honest management [Never took any meaningful remuneration, not excessive and unreasonable related party transactions like Suashish Diamonds, consistent dividend payout ratio maintained at 20% & more]

- Faster distribution of cash and shares than my estimates.

- Focus on expected returns rather than merely focussing on downside or opportunity cost. [To be very frank at the time of original analysis I did not have very clear idea of concept of expected returns. But in hindsight I can say that was the case]

And lastly lots of LUCK.

Jollyboard

You can read the analysis in detail here . This was again a tricky case and shows how delisting is dynamic and different delisting situations needs to be played and analysed differently.

Some points worth noting

On traditional parameters, valuations might have looked steep even in the price range of INR 400-500, but one needs to take a look at hidden value of real estate. Value of surplus real estate was more than INR 350crs.

- Shareholding was again very tricky. Company required 5% for delisting to be successful. Promoter Top 3 shareholders held around 3%. But the tricky part was around 2% was held by one entity which was holding shares for more than 8 years and possibility of related party could not be ruled out.

But I was not certain whether there will be discovery of fair price. May be I failed to appreciate the difference between Chettinad Cements, Binani Cements and Jollyboard. In Jollyboard case, required shareholding was widely distributed. But again in case of Nirma, despite the fact that required number of holding was distributed among more than 40 entities, they cooperated with company. So nothing is black and white in case of delisting. Another thing which I have noticed that generally market gets it right whether it’s a case of collusion among shareholders or not [Ofcourse there will be some exceptions]. So it might be good idea to track whether market price is above or below floor price to get the some indication of collusion among shareholders. In conclusion, I feel despite uncertainty, one should focus more on expected returns and quality of management.

Fairfield Atlas

This case shows that rarely you will get a situation in which everything is perfect. If you do get such situations returns won’t be attractive enough. Here the biggest risk was not price discovery, but whether the book will be built or not. It was again one of those situations where there was huge upside accompanied with lots of uncertainty. It was possible to make between 20-30% returns within 3 months. You can download detailed note from here which I shared with few of my friends.

Some of the reasons for success of this investment idea, I think were:

1) Concentrated shareholding, but still requiring participation from anther 20-30 shareholders.

2) Fundamentals were decent.

3) It was trading at around EBITA multiple [FY12 EBITA] of around 10x. This was not neither a cheap nor an exorbitant valuation.

4) Strong incentives to delist. the new Segment CEO of parent company is to located in Delhi, starting from FY 13. Company had closed down certain plants in other locations and was using Indian unit for exports. [Exports had increased from 18crs in FY10 to 130cr by FY12. FY12 exports were 30% higher than its previous peak of INR 100cr in FY08.

5) Finally lots of luck.

Denso India

This case again shows how complex and dynamic delisting situations are and many times we can do only post-mortem of why and how certain things happen or did not happen.

You can read about the original investment case here You can download mindmap summary from here

I did analyse this opportunity when share price was around 70 [Final delisting price was INR 140] and did not invest mainly for following reasons

1) Company disposed off small motor business to one of its related entities. This unit was contributing 33% to topline but whole profits of the company for FY 12. Though disposal was close to fair value of 2x BV.

2) Fundamentals were not good. Sales grew by 15% CAGR between 2005-10 but EBITA remained flat. Though average pre-tax RoIC was decent at 17% for 2005-10 it was on declining trend, and was only 9% for 2010.

3) Shareholding was fragmented and company required support of more than 50-60 shareholders for delisting to be successful. Going by APW president case, I decided to give this situation a pass.

The only attractive point which was at INR 70 company was trading at 1.4x BV and it was not unreasonable to expect final delisting price of 1.8-2x.

But Expect the unexpected when investing in uncertain situations – UP Hotels

Fat tail risk represents “risks of a particular event occurring that are so unlikely to happen and difficult to predict that many choose to ignore their possibility”. UP Hotels is one of the best examples such fat tail risks.

My original analysis of UP hotels was again a speculation on the possibility of delisting, as promoter holding was more than 88%, there was high probability of delisting. Again the incentive was high as, company with room inventory of around 645 rooms in tier II cities with excellent rating on tripadvisor.com, was trading on EV of INR 150 crs or EV of 25 lakhs per room. As expected on 13 Feb 2013, company announced its delisting plan. You can download my analysis from here.

But on 27 May 2013, company dropped a bomb announcing withdrawal of delisting plan and instead decided to opt for bonus issue route to reduce the promoter’s stake to 75%. I thought if company is issuing bonus shares only to minority shareholders then its much more attractive. As now EV per room declines from 25 lakhs to only 9 lakh and post bonus issue it was providing dividend yield of close to 4%. Download the mindmap summary from here.

But I FAILED to notice a small para in announcement.

There was ongoing dispute among promoters which the company never disclosed. Even in the above announcement no hint was given of dispute among promoters. Even annual report does not contain any such information. As a result bonus issue is hanging in the middle. Now this case is not much different from Jollyboard. Private value of assets is much higher than market value and it’s in the interest of promoters to get the company delisted. Again shareholding pattern is more or less like Jollyboard. Management has not done anything in the past against minority investor interest.

This is one of the reasons why I feel delisting selection has to be by elimination, factoring the worst case scenario in calculating expected returns. At the same time adequate importance should be given to fundamentals, valuation and incentive to delist. But it will be wrong lesson to learn that one should avoid uncertain situations because of what happened in UP Hotels case.

Conclusion:

One should focus on positive expected returns rather than merely on downside. In many situations like Aeonian investments, Fairfield Atlas, Jollyboard etc it was difficult at the time of investment to guess whether the delisting will be successful or not, but there was enough margin of safety. Ofcourse as highlighted by UP hotels case, unexpected things will happen. I would like to end this by reiterating Seth Klarman quote on uncertainty from his book “Margin of Safety”

Most investors strive fruitlessly for certainty and precision, avoiding situations in which information is difficult to obtain. Yet high uncertainty is frequently accompanied by low prices. By the time the uncertainty is resolved, prices are likely to have risen. Investors frequently benefit from making investment decisions with less than perfect knowledge and are well rewarded for bearing the risk of uncertainty. The time other investors spend delving into the last unanswered detail may cost them the chance to buy in at prices so low that they offer a margin of safety despite the incomplete information. [Emphasis mine]

Excellent analysis. I am learning something new and impactful here after a very long time. Though that says more about me, it also says a lot about your investment acumen as well.

Please keep writing.

Warm regards, Kimi

LikeLike

Thanks Kimi

LikeLike

Pingback: Delisting Framework – Part IV – Use Checklist & Mindmaps | Contrarian Edge

Pingback: Some current delisting situations | Contrarian Edge

Pingback: Claris Life Buyback Analysis | Contrarian Edge

Pingback: The Battle for Investment Survival | Contrarian Edge

Pingback: Amitabh Singhi: Follow Graham to Survive | Contrarian Edge